Audit Procedures for Cash and Cash Equivalents

Through an examination treatment. MTA control environment was insufficient to safeguard and detect actual or suspected loss of cash and cash equivalents.

Audit Procedures For Cash Carunway

Let us look into details.

. LBI Industry Guidance 04-0118-007 dated 212018 established procedures to ensure waiver requests are applied in a fair consistent and timely manner under the regulations. 41510 Pursuant to RCW 4309230 Annual Reports are to be certified and filed with the State Auditors Office SAO within 150 days after the close of each fiscal year. The first is cash which comprises cash on hand and at the bank.

41520 The following matrix provides additional details regarding reporting. Read more provides the user with an audit opinion stating that financial statements show a true and fair view in all. Auditor-General means the Auditor-General appointed in accordance with the Constitution.

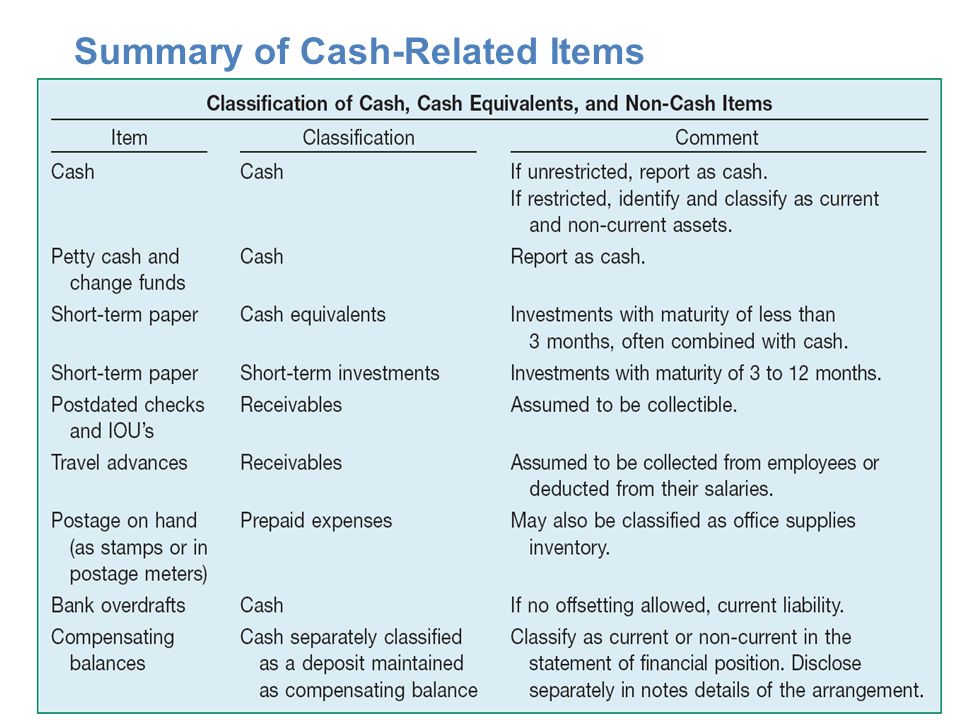

Of three months or less are cash and cash equivalents. It includes cash on hand demand deposits and other items that are unrestricted for use in the current operations. 1 Page 1 of 17 AUD Handouts No.

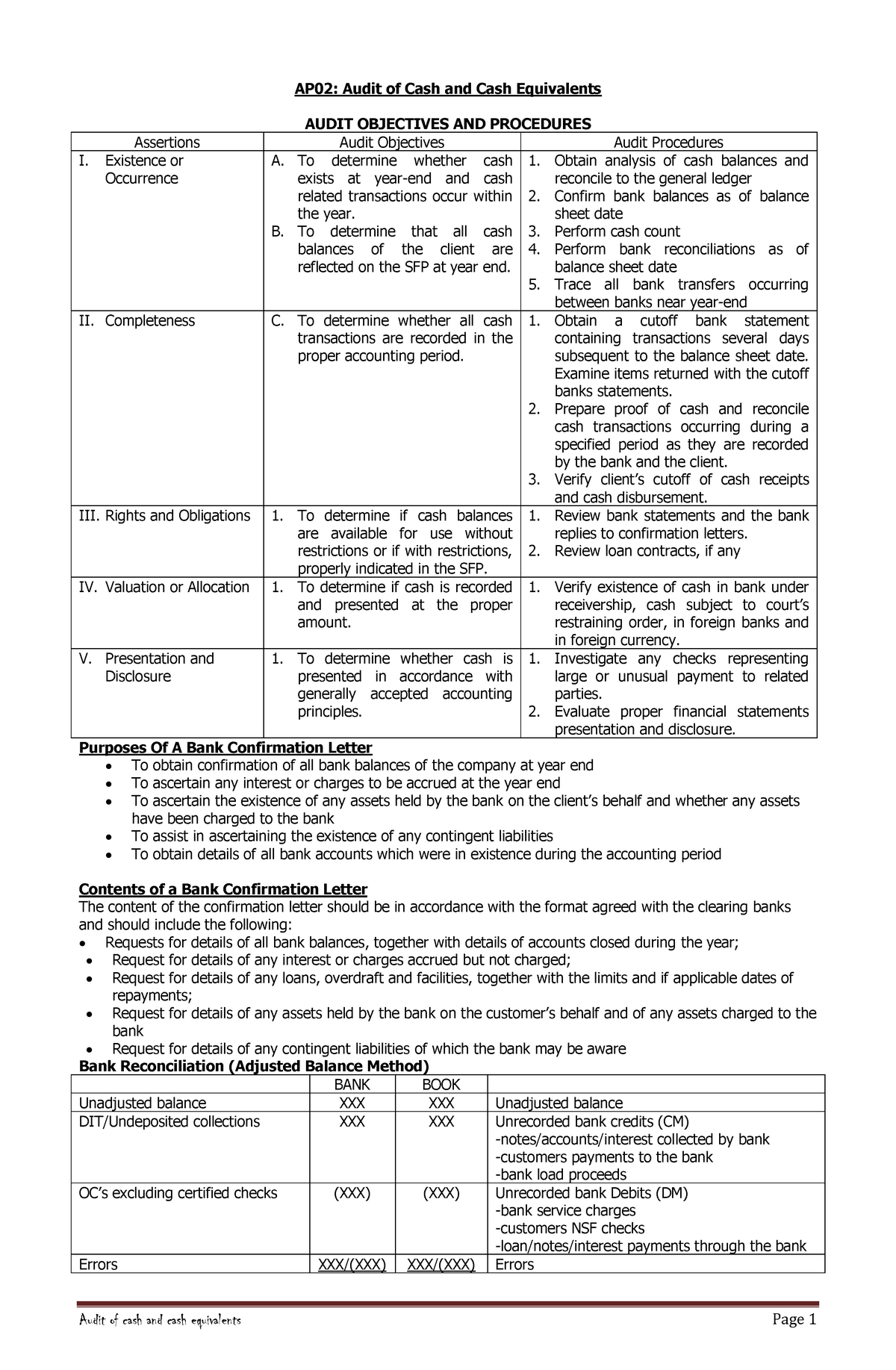

Please include the completed reference with your. Internal control includes corporate governance company policies segregation of duties authorized approvals for purchases designated signature authority with limits payments reconciliation and bank. Account receivable or cash and cash equivalents should also affect whether it is the cash sale or credit sales.

True and Fair View An unqualified clean audit report Audit Report An audit report is a document prepared by an external auditor at the end of the auditing process that consolidates all of his findings and observations about a companys financial statements. 26 Cash flow statement Cash flows are reported using the indirect method whereby profit loss before. All cash and bank audit procedures need to be properly documented and all audit documents should be dated with authorization of the preparer and reviewer.

Cash and cash equivalent fringe benefits for example gift certificates gift cards and the use of a charge card or credit card no matter how little are never excludable as a de minimis benefit. As noted in Table 2 the system had approximately 114 million in cash and cash equivalents in local bank accounts and approximately 793 million in the state treasury at June 30 2012. Here is the sale return journal entry.

Step 3 - Letter s of Reference and Proof of Insurance. Prove the accuracy of the cash balance reflected in the ledger cashbook 3 cash receipts record CRR4 check disbursements record CkDR5 cash disbursements record CDR or their equivalents such as cash receipts register CRR petty cash register PCR6 cash disbursements register CDR7 and individual daily proof sheet and transaction sheet daily. Controlling cash receipts and cash disbursements reduces erroneous payments theft and fraud.

It allows the auditor to see how the entity pays its bills whether it has been doing it in accordance with its internal policies and records it following the applicable accounting standards. ASUNCION CPA MBA DEFINITION OF CASH Cash includes money and other negotiable instrument that is payable in money and acceptable by the bank for deposit and immediate credit. Bank account means an account at a bank into which moneys are deposited and drawn.

Letter of Reference Submit the Letter of Reference from the application and have it completed by a past client or employer who may comment about your construction workexperience OR a code official who has inspected your workOnly one reference letter is necessary. This will help the auditor to plan audit procedures for cash and cash equivalents. As of December 31 20X2 and 20X1 cash and cash equivalents consist of an operating checking account.

41 Reporting Principles and Requirements. Related article Audit Procedures for Cash and Cash Equivalents It is really important to ensure that inventory-related measures are properly taken care of essentially because of the tantamount importance it has not only on the Income Statement but also on the Balance Sheet. The procedures selected depend on the auditors.

Cash and Cash Equivalents for Year Ended June 30 In Thousands Carrying Amount 2012 2011 2010 Cash in bank 56362 60809 46487. Cash equivalents are short-term balances with an original maturity of three months or less from the date of deposit highly liquid investments that are readily convertible into known amounts of cash and which are subject to insignificant risk of changes in value. Recommendation 31 We recommend Mass Transit management ensure physical security over manual receipts cash and cash equivalents eg bus tickets bus passes taxi coupons.

They will need to get idea about the number of banks types of bank accounts authorized signatories. Auditing Cash Disbursements is an important part of the work performed when auditing cash and cash equivalents. An audit report is an independent opinion of a personfirm ie.

In Cash and Cash Equivalents there are two separate components. Audit committee means a committee established under section19. A Form 1099 Information Return or its foreign equivalents.

Cash Flows from Capital and Related Financing Activities Cash flows from capital and related financing activities include acquiring and disposing of capital assets borrowing money to acquire construct or improve capital assets repaying the principal and interest amounts and paying for capital assets obtained from vendors on credit. Cash resources means cash in form of Bank notes or coins. Cash control is cash management and internal control over cash.

Whether in cash or property is properly taxable as a. Auditing Cash Disbursements Risk. The second is Cash Equivalents which are investments that are short-term highly liquid and are readily convertible to.

Cash and Cash Equivalent is scoped under IAS 7 Statements of Cash Flows. Auditor about whether the financial statements present a true fair view of the state of affairs of the entity profitloss of the entity cash flows for the year and such opinion is given after performing reasonable audit procedures so obtain sufficient appropriate evidence for the assurance. Identity verification in 220 countries An all-in-one KYCAML service for preventing fraud and staying compliant 93 users verified on the first try 247 Technical and Customer Support.

However meal money and local transportation fare if provided on an occasional basis and because of overtime work may be excluded as discussed later. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. 05 DARRELL JOE O.

415 Reporting Requirements and Filing Instructions for Cities and Counties. Auditing Cash and Cash Equivalents. For the seller revenue can be revised by debiting the sales return account A contra account by nature and crediting cashaccounts receivable with the invoice amount.

Audit Cash Cash Equivalents Youtube

Audit Cash And Cash Equivalents Pdf Cheque Deposit Account

Audit Of Cash And Cash Equivalents Existence Or Occurrence A To Determine Whether Cash Exists At Studocu

Cash Audit Procedures Assertions Objectives Management Cash Exists Include All Transactions That Should Be Presented Represents Rights Of The Entity Ppt Download

0 Response to "Audit Procedures for Cash and Cash Equivalents"

Post a Comment